In an period of financial uncertainty and fluctuating market circumstances, many traders are turning to various property to safeguard their wealth. Amongst these options, gold has consistently stood out as a dependable retailer of value. Gold Individual Retirement Accounts (IRAs) have emerged as a popular choice for those seeking to diversify their retirement portfolios. This article explores the top gold IRA companies currently accessible, highlighting their distinctive offerings, advantages, and what sets them apart in the aggressive panorama of treasured metals investment.

Understanding Gold IRAs

Before delving into the leading companies, it is essential to know what are gold ira companies (Irasgold.com) a Gold IRA is. A Gold IRA is a self-directed particular person retirement account that allows investors to carry physical gold, as well as different treasured metals, as a part of their retirement savings. Such a account presents several advantages, including tax advantages, safety in opposition to inflation, and the potential for long-time period appreciation.

Standards for Selecting the Best Gold IRA Companies

When evaluating gold IRA companies, several components ought to be considered:

- Reputation and Trustworthiness: Search for companies with a solid track report and positive customer opinions.

- Fees and Costs: Understand the price construction, including setup fees, annual maintenance charges, and storage prices.

- Funding Options: A various vary of merchandise, including gold bullion, coins, and different valuable metals, can enhance investment flexibility.

- Customer service: Efficient buyer assist can make the investment course of smoother and more pleasurable.

- Academic Sources: Corporations that provide academic supplies can help investors make knowledgeable decisions.

Top Gold IRA Companies

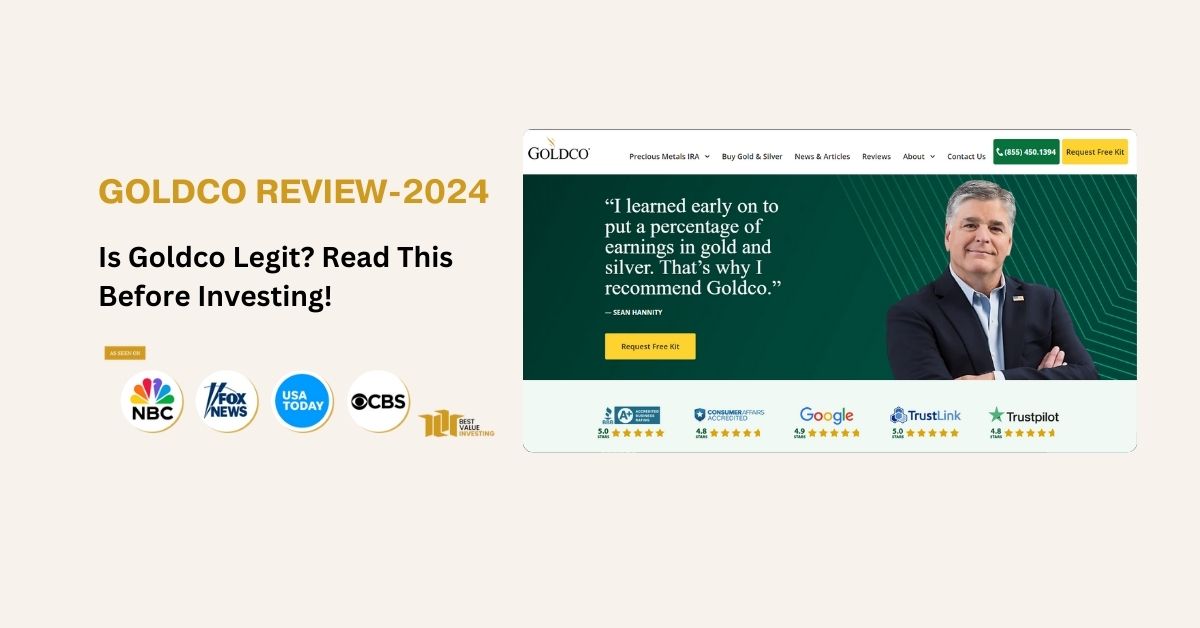

1. Goldco

Goldco is likely one of the leading gold IRA companies within the business. Established in 2006, Goldco has built a fame for glorious customer service and a commitment to serving to purchasers secure their financial futures. The corporate provides a variety of gold and silver products, including bullion and coins, and gives a consumer-pleasant platform for managing investments.

Professionals:

- A+ ranking with the better Enterprise Bureau (BBB).

- Offers a free gold IRA information to educate potential investors.

- Gives a buyback program for added safety.

- Minimal investment requirement may be higher than some rivals.

2. Birch Gold Group

Birch Gold Group has been in the enterprise since 2003 and specializes in treasured metals IRAs. They concentrate on educating their clients about the advantages of investing in gold and other metals. Birch Gold Group provides a wide range of products, together with gold, silver, platinum, and palladium.

Pros:

- Sturdy educational resources and buyer assist.

- A+ rating with the BBB and quite a few optimistic customer testimonials.

- Presents a large choice of IRA-permitted products.

- Greater charges compared to some other firms.

3. Noble Gold Investments

Noble Gold Investments is understood for its easy method to gold IRAs. Founded in 2016, the corporate has quickly gained a fame for its transparency and dedication to customer satisfaction. Noble Gold presents a diverse vary of valuable metals, together with gold, silver, and rare coins.

Pros:

- No minimal funding requirement for their IRA.

- Offers a free gold and silver funding guide.

- Provides a novel "Noble Categorical" service for fast and straightforward account setup.

- Restricted funding options compared to bigger corporations.

4. Advantage Gold

Benefit Gold is a newer participant in the gold IRA market but has rapidly made a reputation for itself. Based in 2014, the corporate prides itself on its academic method and dedication to serving to clients make knowledgeable investment decisions. Benefit Gold presents a wide range of valuable metals, together with gold, silver, platinum, and palladium.

Execs:

- A+ rating with the BBB and optimistic buyer feedback.

- Concentrate on training with comprehensive assets accessible.

- Competitive pricing and transparent charge structure.

- Limited product selection in comparison with more established opponents.

5. American Hartford Gold

American Hartford Gold is a household-owned company that has gained recognition for its commitment to customer support and integrity. The company focuses on providing purchasers with a personalized expertise and gives a variety of gold and silver products for IRAs.

Pros:

- A+ rating with the BBB and numerous optimistic evaluations.

- Gives a value match assure on gold and silver purchases.

- Supplies a wealth of academic assets for investors.

- May have larger fees in comparison with some competitors.

The Significance of Research

Whereas the businesses talked about above are among the highest contenders in the gold IRA space, it's essential for investors to conduct their research. Each investor's monetary state of affairs is unique, and what works for one particular person is probably not suitable for an additional.

Conclusion

Investing in a Gold IRA can be a prudent technique for those trying to guard their retirement financial savings from market volatility and inflation. The top gold IRA companies offer varied merchandise, companies, and academic sources to assist traders make knowledgeable choices. By taking the time to analysis and examine these companies, individuals can discover the right companion to assist them safe their monetary future with valuable metals. As interest in gold and other different investments continues to grow, these companies are nicely-positioned to help buyers in navigating the complexities of the gold IRA landscape.

In conclusion, whether or not you are a seasoned investor or simply starting your journey into precious metals, the appropriate gold IRA company can make all of the distinction in reaching your financial targets. By contemplating elements resembling repute, charges, funding options, and customer support, you possibly can confidently choose a supplier that aligns with your investment strategy and helps you construct a safe retirement portfolio.